Financial denial often stays in place because it feels easier than change. People do not simply avoid reality—they defend it. They tell themselves stories that justify delay, create distance from responsibility, or make dysfunction seem reasonable. These stories sound like survival. In truth, they are mechanisms that maintain the problem.

Common phrases help keep denial intact. A person might say, “I’ll deal with it next month,” or “It’s not that bad.” Others compare themselves downward: “At least I’m not as bad off as them.” These statements provide temporary comfort. They offer just enough relief to avoid action, even when the consequences of inaction continue to build.

Excuses often feel rational in the moment. A temporary job loss becomes a reason to pause budgeting. A recent vacation becomes the justification for added credit card debt. These moments are not unusual, but the mindset that follows matters. When excuses become patterns, financial instability becomes normal.

This behavior is not always conscious. Many people do not think of themselves as avoiding the truth. They believe they are managing, adapting, or waiting for a better time. In reality, each excuse pushes clarity further away. The longer denial is supported by rationalizations, the harder it becomes to recognize the need for change.

Emotional Patterns That Block Change

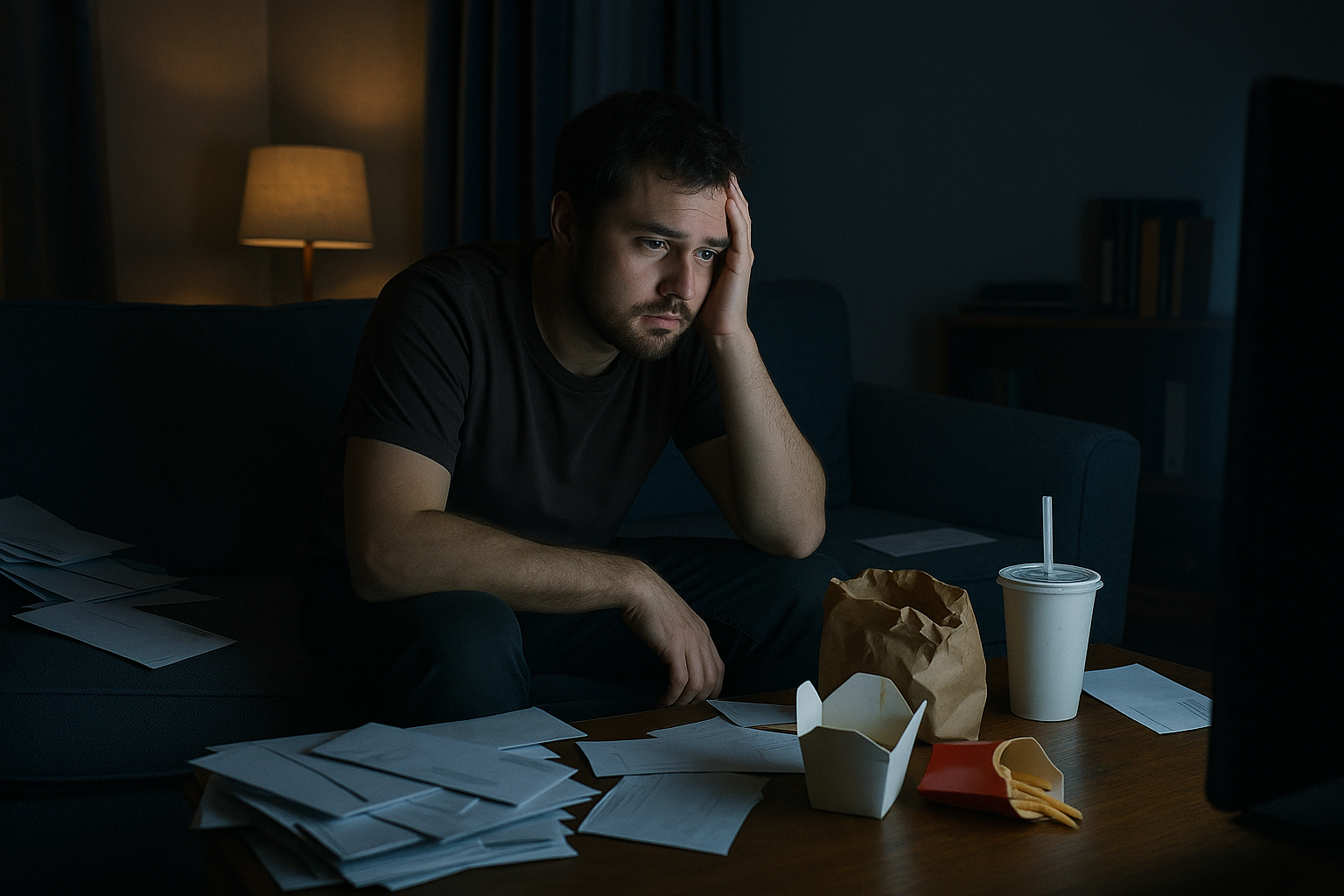

Excuses often begin as protection. Over time, they evolve into emotional routines. The discomfort of facing financial instability leads many people to avoid anything that reminds them of the problem. They stop opening statements. They ignore phone calls. They delay conversations about money, even with those closest to them. This avoidance becomes a pattern that replaces problem-solving with silence.

Fear plays a central role in this loop. Fear of judgment, fear of failure, and fear of change make it easier to maintain the status quo than to confront uncertainty. Many individuals have tried and failed in the past, and the memory of that failure becomes a reason not to try again. Others fear what they will see if they look too closely at their financial situation, so they choose not to look at all.

Shame also reinforces denial. The feeling that one should “already know better” prevents people from asking for help or even admitting the problem. Instead of seeking clarity, they retreat further into distraction. Entertainment, impulse spending, or busyness can become tools of avoidance that feel productive but serve no corrective function.

These emotional patterns are not random. They form a self-protective structure designed to minimize pain. The structure works in the short term. It limits exposure to discomfort and shields self-image. Over time, though, it creates a closed system where no progress is possible. The behavior that was meant to reduce harm becomes the reason harm continues.

Normalizing Dysfunction

Financial denial does not exist in isolation. It is reinforced by a culture that treats unhealthy money habits as ordinary. Debt is presented as manageable. Overspending is seen as normal. The behaviors that create long-term instability are often encouraged, joked about, or quietly ignored. In this environment, denial becomes easier to maintain because it blends in.

People rarely talk openly about financial stress. Most keep their concerns private, even when struggling. This silence creates the impression that others are doing fine, even if they are not. When everyone seems to be getting by, the pressure to examine one’s own situation fades. It becomes easier to assume that debt is just part of life.

Cultural patterns support this assumption. Advertising encourages spending regardless of income. Easy access to credit normalizes living beyond one’s means. Workplaces, neighborhoods, and social circles often reward the appearance of success without questioning how it was achieved. These signals shape expectations. They train people to tolerate imbalance as long as it looks acceptable from the outside.

Over time, dysfunction becomes familiar. The symptoms—anxiety, missed payments, lack of savings—start to feel like a standard part of adulthood. This mindset turns denial into a shared language. It becomes not just a personal barrier but a cultural one. When dysfunction is normalized, few people feel motivated to change it.

Denial thrives when excuses go unchallenged. Emotional habits and cultural signals reinforce the belief that financial instability is normal or inevitable. These patterns do not feel destructive at first. They often appear reasonable, even familiar. Over time, though, they become the reason progress never begins.

Avoidance does not solve the problem. It only extends it. The longer unhealthy patterns are allowed to continue, the more damage they cause. Emotional relief may come from distraction, but the pressure beneath the surface keeps building. Lasting change begins with recognizing the role delay plays in deepening the problem. Avoidance may offer short-term relief, but it clears the way for dysfunction to grow unchecked.

Progress starts when familiar excuses lose their authority. The emotional and social comfort of denial fades once the cost becomes visible. That visibility marks the beginning of accountability—and the first real step toward change.

Finance Health

Focused on long-term growth and financial resilience, Finance Health is a voice of compound interest, consistency, and the long game.