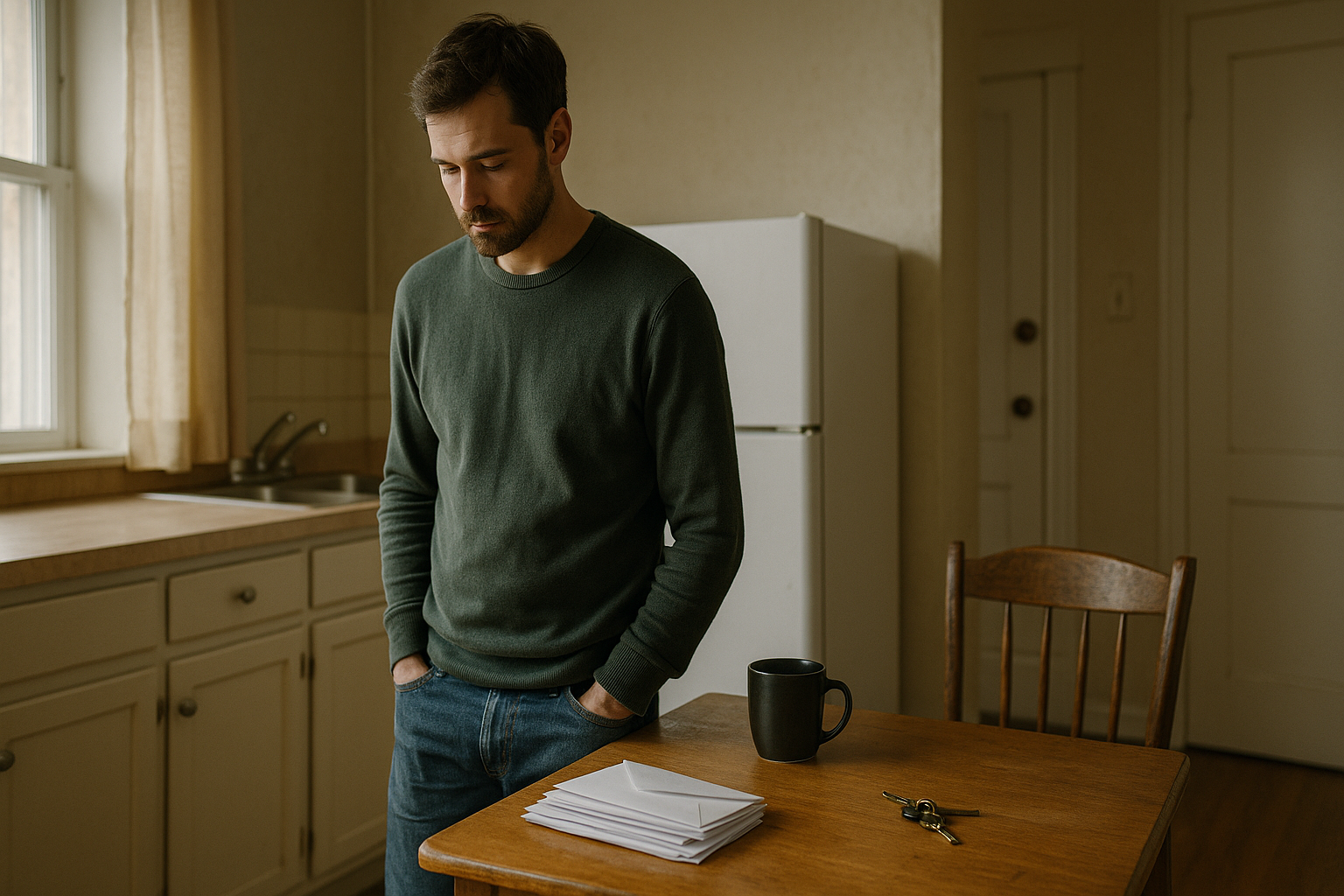

Financial denial allows a person to live behind a controlled image while avoiding the truth about their situation. A household may appear comfortable, but behind closed doors, debt accumulates and savings remain untouched. The signs of imbalance often show up in quiet ways—credit card balances that never shrink, spending that exceeds income, or a growing sense of unease that gets pushed aside.

This mindset forms slowly. It begins with justifying small decisions, like financing a car that stretches the budget or using credit to cover gaps in spending. Over time, those patterns become normalized. The presence of income creates a false sense of control, even when expenses outweigh it. As long as payments are being made, the system appears to function.

Comparison reinforces the illusion. When neighbors and coworkers follow similar spending habits, the pressure to keep up masks the need to slow down. Lifestyle becomes performance. As long as nothing collapses, the denial holds.

Eventually, avoidance becomes routine. People stop checking balances, delay paying bills, and steer away from conversations about money. The discomfort of acknowledging reality feels heavier than the strain of maintaining denial. Financial stress becomes background noise, persistent but manageable, until it isn’t.

Clarity requires confrontation. Denial breaks only when a person chooses to face what they have ignored. Without that decision, every attempt at improvement remains superficial. No budget, tool, or plan can succeed until the truth is acknowledged.

Appearance vs. Reality

Modern life rewards the appearance of financial success. A polished exterior—cars, clothes, vacations, a large home—becomes the benchmark for stability. Many individuals build their lives around these visible markers, even when they come at the cost of long-term security. The image holds as long as the payments continue.

This dynamic creates pressure to maintain a lifestyle that does not match actual financial capacity. People take on loans to afford upgrades, use credit to bridge income gaps, and avoid savings to fund daily expenses. The decisions are often subtle and incremental, making them easy to justify in the moment. The result is a life shaped by payments rather than ownership.

The problem compounds when these decisions are not questioned. There is little room for reflection in a culture that equates spending with status. Financial discomfort becomes easier to tolerate than the idea of stepping back. In this environment, denial feels less like avoidance and more like survival.

What cannot be seen is often ignored. Few people display their financial instability. They do not advertise overdraft fees or retirement shortfalls. Because these realities remain hidden, the illusion of collective success strengthens. It becomes easier to believe that debt is normal and that everyone is simply managing it in private.

The contrast between appearance and reality creates a false sense of control. A person may appear successful while relying on a fragile financial base. Transformation begins when that illusion no longer drives decisions. Real stability comes from discipline, structure, and clarity.

The Fitness Metaphor

The shift from denial to change often begins with a personal reckoning. A person may ignore the slow build-up of unhealthy habits until one moment forces awareness. Financial transformation starts in the same way. A sudden realization—a bounced payment, a rejected loan, a sleepless night—breaks through the illusion and exposes the cost of avoidance.

The comparison to physical fitness is more than symbolic. It clarifies what has gone wrong and what must happen next. Many people live with financial habits that create invisible strain. They do not notice the burden because it has become familiar. Like someone avoiding the scale or ignoring symptoms, they continue as though nothing is wrong, hoping that time will fix what discipline has not addressed.

No progress can begin without that first moment of truth. Recognition must happen before any meaningful change. The structure, commitment, and repetition required to restore financial health are similar to the steps used in physical recovery. The goal is not perfection. The goal is progress built on honest assessment and sustained effort.

This moment of realization marks the end of denial. It does not solve the problem, but it opens the path forward. Awareness replaces assumption. Responsibility replaces excuse. From that point, a person can begin the work of transformation with clarity and direction.

Financial denial often seems safer than honesty. It shields a person from discomfort and delay, even as it blocks progress. The appearance of control becomes more important than actual control. Over time, this mindset builds a life around coping instead of correcting.

Change begins with recognition. A clear view of financial reality allows a person to make decisions based on facts instead of assumptions. Without that clarity, every effort remains misdirected.

Acknowledging reality takes effort. That effort creates clarity. Clear decisions lead to structured action, and structure builds momentum. Financial transformation begins when personal responsibility becomes more important than performance.

Finance Health

Focused on long-term growth and financial resilience, Finance Health is a voice of compound interest, consistency, and the long game.