When you think about building a financial plan, it is easy to believe that there is one model that works for everyone. You might expect the components to fit together in an obvious way. You might look at investment decisions, tax responsibilities, insurance needs, estate considerations, and general spending choices and expect them to form a single, uniform system. A financial plan can be confusing when these pieces do not connect neatly or when you cannot tell where each part belongs.

Your starting point is recognizing that financial planning involves several areas of your life, and each area influences the others. You begin by questioning where each piece fits so that you can understand how your structure works.

Understanding the Purpose of Your Financial Plan

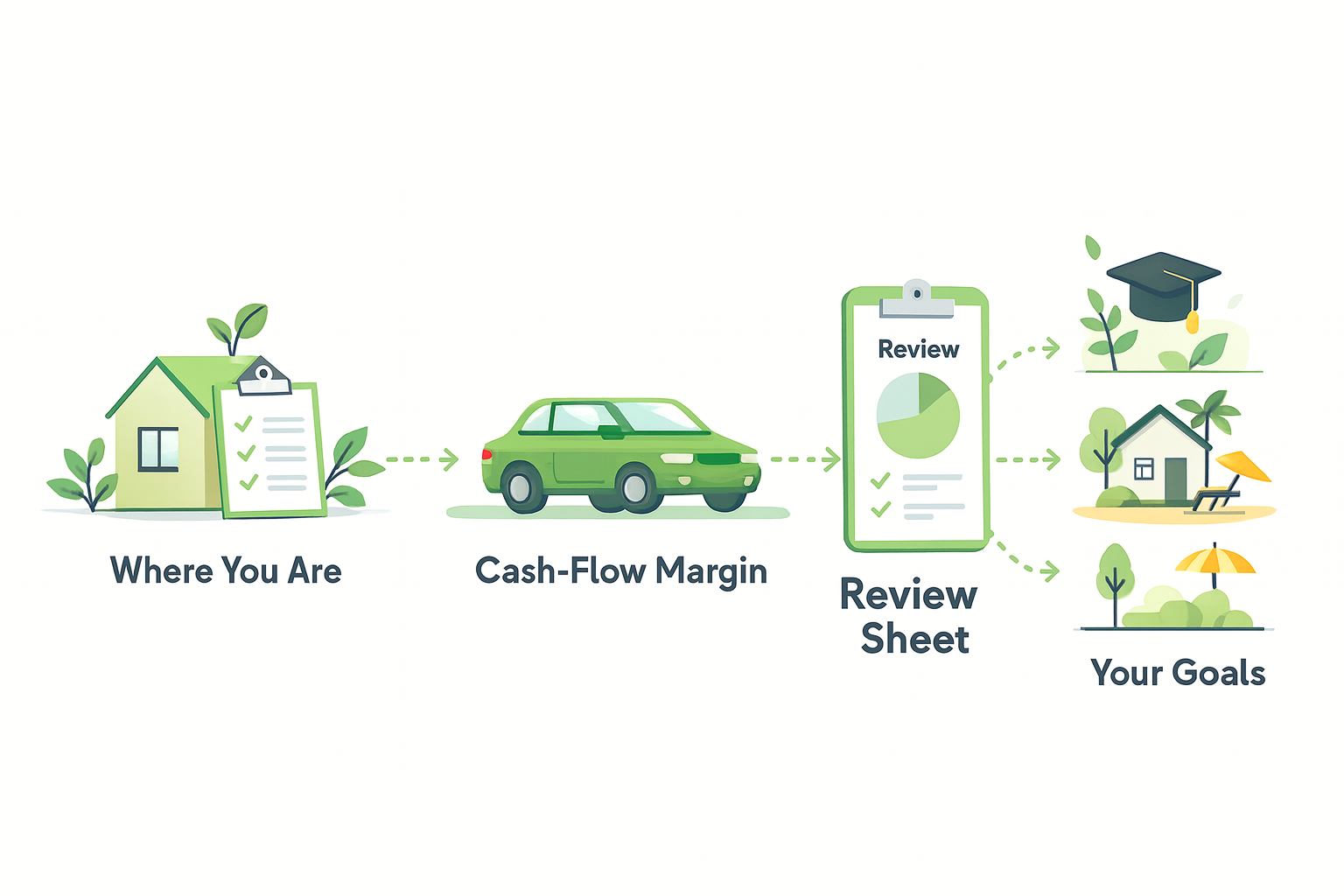

You can think of a financial plan as a projection that lays out how your income will move in and out of your account(s) over a defined period. When you make those actions clear for yourself, a financial plan becomes a map, and your cashflow margin becomes the vehicle to your goals

Understanding the Four Stages of a Functional Plan

The planning process follows four stages, and each stage plays a distinct role in shaping your direction. You begin by forming a list of your present situation. This list shows your net worth and the pattern of income and expenses that define your daily financial life. When you understand your current situation, you will have a starting point.

The second stage is to establish the goals. They may relate to giving, stability, education, lifestyle needs, or other priorities that matter to you. When you define these goals, you create destinations and meaning to your efforts.

The third stage focuses on increasing your cash-flow margin. This margin is the difference between what comes in and what goes out of your account(s). It is vehicle that takes you from your starting point to each of your financial goals. You build this margin by adjusting expenses, managing debt, reallocating assets, or making other decisions that create progress.

The fourth stage is controlling your margin once it’s in motion. You maintain this control through scheduled review and disciplined spending. When you revisit your decisions regularly, you ensure that your controlled margin in bringing you closer to your goals, the destination of your plan

These four stages of planning help you understand where you are, where you want to go, the actions you must take to form a disciplined margin, and the habits that keep you on course.

Seeing How the Planning Process Fits Together

Begin by establishing where you stand right now, which includes your net worth and the pattern of your income and expenses. Define the goals that represent the direction you want to take. Once your goals are in place, you identify actions that can increase your cash-flow margin. The final step involves controlling your plan through review and adjustment.

Recognize How Specific Decisions Increase Your Margin

You may decide to reduce certain living expenses, adjust how you manage debt, or sell assets that are no longer necessary for your long-term direction. You might change your tax withholdings once you understand how they affect your net income for the year. You could also reconsider how much income you rely on from investments.

An analysis of your actions reveals how your decisions relate to your overall plan. A negative margin can turn into a positive one when your spending patterns align with your objectives.

Evaluating Whether Your Plan Supports Your Long-Term Direction

You may have goals related to giving, education, stability, or lifestyle. Each of these areas carries its own set of decisions. When you choose to direct part of your margin toward one objective, you reduce the amount available for another. For example, using savings for a contribution or project can reduce your flexibility in an emergency. The important point is that you understand the effects of each choice on the priorities you have already identified.

Using Your Margin to Support Practical Goals

A positive margin gives you options that were not available before. You can direct part of it toward major goals, such as replacing a vehicle or addressing a household need. You may find that reducing certain expenses forces you to make changes to your daily life.

An annual review gives you a broad view of your progress, and reviewing more frequently in the early stages can help you develop discipline.

Your positive margin is the fruit of subtle savings. As you make decisions, measure their effects. When you do this consistently, you will have a personal financial system that supports your goals and reflects your priorities.

Finance Health

Focused on long-term growth and financial resilience, Finance Health is a voice of compound interest, consistency, and the long game.